CWT Software Configuration Handbook

Element Path: <cwt><ARTICLE><tabularVAT>

Tabular VAT is calculated based on the purchase amount and can be added or included to the purchase.

The tax can be added to the purchase amount or included into the amount.

•When adding a tax the amount to pay is the net amount.

•When including tax the amount to pay is the gross amount

see an example at the end of this page

The tax amount depends on the purchase amount. Up to four tax parts can be calculated to the total tax. A table defines how much tax to be calculated based on the purchase amount. The tax can be both a fixed-and proportional amount.

Since the tax is calculated based on the purchase amount the costumer must select the time or purchase amount before the tax is calculated. This is done by stepping time or amount in the purchase application. For each increment in purchase amount the tax will be calculated and added or included.

•Up to 4 vat parts can be specified, if omitted treated as zero.

•A Day Type can be used to specify tabularVAT tables for specific days. See CALENDAR for a description how day types work. if a Day Type is used at the start of a purchase, the system will look for a matching tabularVAT table.

Define a tabularVAT element for each Day Type and a default one for the other days.

oIf no tabularVAT table for the specified Day Type is found the default table will be used.

oIf the Day Type is omitted in the configuration the table is valid for all day types.

•It is possible to use several purchase amount intervals.

•The order inside the table is not important. The highest found interval than contains the purchase amount will be used for the tax calculation.

| Important: The VAT attribute in ARTICLE and the default VAT attribute in PAYMENT shall not be used if tabularVAT is used. |

Rounding to the lowest monetary value

Rounding during proportional tax calculation is configurable to round down to the nearest tick or round to the nearest tick.

Rounding to the lowest accepted monetary value

E.g. the company does not accept coins smaller than 0,05$ or 0,25 $.

This method is used for coin purchases.

Since adding tax to the purchase amount after selecting time, the amount to pay can end up in an amount that cannot be paid with coins. The customer therefore will be forced to do an overpayment, or to pay with card, if not paying the even amount.

It is possible to configure rounding down to the lowest accepted monetary value. You can configure how this rounding shall be applied.

• Rounding down the tax parts

•Rounding down the purchase part

•Rounding down both the tax and purchase parts.

The amount to round down is spread proportional over the selected parts.

Separate rounding amount article.

Rounding amount can also be registered in an own article, if a roundup article is defined in:

<cwt><PAYMENTSERVICE roundUpArticleId>

attributes

coinValueAlignmentRoundingRule

| Value: | RoundDownVatPartsTicks: Rounding is proportional to the amount on each VAT part. |

RoundDownPurchaseTicks:

Rounding down is done on the purchase (parking fee) part.

RoundDownVatAndPurchaseTicks:

Rounding is proportional to the amount on each VAT part and parking fee part.

RoundDownVat1PartAndPurchaseTicks:

Rounding is proportional to the amount on VAT1 part and parking fee part.

RoundDownVat2PartAndPurchaseTicks:

Rounding is proportional to the amount on VAT2 part and parking fee part.

RoundDownVat3PartAndPurchaseTicks:

Rounding is proportional to the amount on VAT3 part and parking fee part.

RoundDownVat4PartAndPurchaseTicks:

Rounding is proportional to the amount on VAT4 part and parking fee part.

RoundDownVat1PartTicks:

All rounding is done on the amount on VAT1 part.

RoundDownVat2PartTicks:

All rounding is done on the amount on VAT2 part.

RoundDownVat3PartTicks:

All rounding is done on the amount on VAT3 part.

RoundDownVat4PartTicks:

All rounding is done on the amount on VAT4 part.

| Default: | RoundDownVatPartsTicks |

| Description: | Rounding down the amount to pay including tax to lowest monetary value. The lowest monetary value configured in the Pay unit Coin is used. If coins are not used, the lowest value will be one tick. |

| See the table below for the use of each value. |

dayType

| Value: | 0 – 255 |

| Default: | (-1) |

| Description: | For which day type the table is valid. |

vatInterval

| Value: | Minimal 1 interval must be defined |

| Default: | - |

| Description: | Row in a Vat table definition |

Example:

PURCHASE RANGE |

CITY |

COUNTY |

TOTAL VAT |

|---|---|---|---|

$0.00 - $2.00 |

$0.00 |

$0.00 |

$0.00 |

$2.01 - $3.00 |

$1.00 |

$0.00 |

$1.00 |

$3.01 - $4.00 |

$1.00 |

$0.00 |

$1.00 |

$4.01-$6.49 |

$1.00 |

$0.50 |

$1.50 |

$6.50-$7.49 |

$1.75 |

$0.75 |

$2.50 |

$7.50-$14.49 |

11% |

5.5% |

16.5% |

$14.50-$15.99 |

$5.00 |

5.0% |

$5.00 + 5% |

> $16.00 |

22% |

11% |

33% |

The interval from $0.00 to $2.00 is not defined as the VAT amounts are zero

<tabularVAT coinValueAlignmentRoundingRule="RoundDownVatAndPurchaseTicks">

<vatInterval intervalStart="201" vatPart1="100" vatPart2="0" />

<vatInterval intervalStart="401" vatPart1="100" vatPart2="50" />

<vatInterval intervalStart="650" vatPart1="175" vatPart2="75" />

<vatInterval intervalStart="750" vatPart1="11%" vatPart2="5.5%" />

<vatInterval intervalStart="1450" vatPart1="5%" vatPart2="5%" />

<vatInterval intervalStart="1600" vatPart1="11%" vatPart2="11%" />

</tabularVAT>

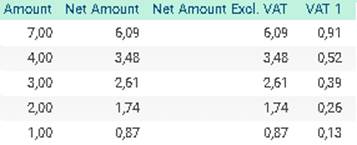

Example included VAT

A tariff of 500 per 15. (2$ per hour) You want to pay 15 minutes.

You want to have the VAT included, so the parker pays still 500 ticks for 15 minutes.

The included VAT will be 65 ticks

The net amount will be 435 ticks

The Tariff is linear 500 per 15, we want to pay 500, 1000, 1500 and having the VAT included

The Vat1 is set to 1500 (15%)

After 15 mins (500 ticks) |

After 30 mins (1000 ticks) : |

After 45 mins (1500 ticks) : |

Purchase Ticks is 500 |

Purchase Ticks is 1000 |

Purchase Ticks is 1500 |

Vat1 is 65 (rounded from 65.22) |

Vat1 is 130 (rounded from 130.43) |

Vat1 is 196 (rounded from 195.6522) |

<cwt>

<ARTICLE>

<tabularVAT dayType="1" coinValueAlignmentRoundingRule="RoundDownVat1PartTicks" vatCalculationRoundingRule="RoundHalfUp">

<vatInterval intervalStart="000" includedVat="true" vatPart1="15%" />

</tabularVAT>

</ARTICLE>

</cwt>

WebOffice screenshot