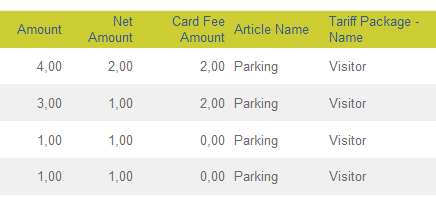

This section describes the way Card fee taxes are calculated:

•If the Vat1 to Vat4 amounts are known:

Net Amount = Amount - Vat1 - Vat2 - Vat3 - Vat4 - Rounding – Overpayment.

•If Vat1 to Vat4 are unknown:

The purchase amount is built up from three amounts:

•Net Amount – The amount for the time purchased.

•VAT – The value added tax on the Net Amount (displays the percentage VAT for this article).

•Card Fee – The additional fee over Net amount.

The purchase amount listed in WebOffice (the Amount field) equals to Net Amount + VAT + Card Fee.

•If no card fee is used the net amount and the amount will be equal.

| Note: The VAT column displays the percentage VAT for this article expressed in 100 times the percentage. E.g., 2500 mean 25%. This field does not show the actual VAT paid. |

Example involving all fields:

Tariff description:

•Parking Fee is $1.00/hour.

•City Tax VAT1 is 5%.

•County Tax VAT2 is 15%.

•Card Fee is $1.00.

Scenario:

Customer chooses to buy 3 hours of parking and pays with coin.

This gives the following values:

•Net Amount = 3 x $1.00 = $3.00.

•City Tax VAT1 5% of $3.00 = $0.15.

•Country Tax VAT 2 15% of $3.00 = $0.45.

•VAT 3 = 0.

•VAT 4 = 0.

•Card Fee Amount = $1.00.

•Total Value = $3.00 + $0.15 + $0.45 + $1.00= $4.60.

•Rounding (down to nearest $0.50) = -$0.10.

The customer now must pay $4.50, but only has $1 coins, so they pay $5.00.

This gives the following values:

•Amount paid = $5.00.

•Overpayment = $5.00 - $4.50 = $0.50.